What We Do

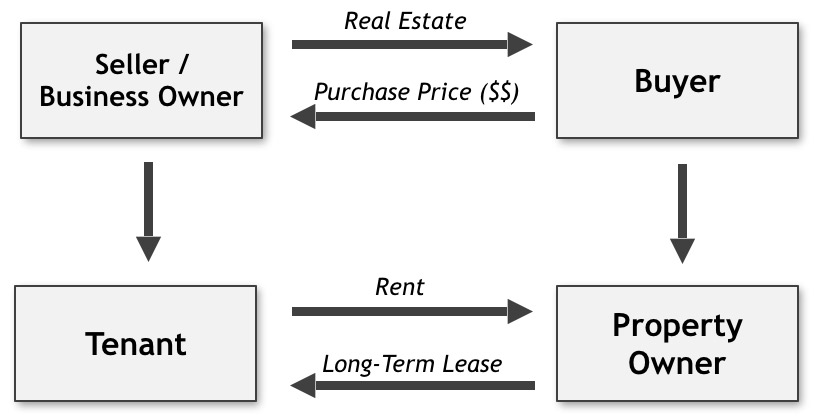

Wellness Real Estate Partners purchases the land and buildings (“real estate”) owned by a behavioral health company/organization and, at the same time, leases the real estate back to the you/the operator in a long-term lease structure.

Real estate sale leasebacks transactions are a simple and effective tool available to business owners to help maximize returns. Real estate secured by a long-term lease will often trade at a higher multiple (based on the rents the business owner will pay) than the multiples of cash flow upon which their operating companies are valued.

Real estate sale leasebacks transactions are a simple and effective tool available to business owners to help maximize returns. Real estate secured by a long-term lease will often trade at a higher multiple (based on the rents the business owner will pay) than the multiples of cash flow upon which their operating companies are valued.

There are many reasons to choose to execute real estate sale leasebacks to generate liquidity that can then be redeployed (i) inside of the businesses to help accelerate growth, either through re-investment in existing facilities or expansion of new facilities or (ii) outside of the businesses, through expansion to a new line of business that helps improve diversification for the owners of the companies.

- Expand & add locations faster

- Build significant cash reserve for on-going operations

- Reduce debt

- Increase your company value

- Free up capital for business operations that would otherwise be tied up in real estate

- Gain from the sale of real estate will increase profitability of the company in the year it is sold, and increase cash on the balance sheet

- An operating lease would not be carried as a long-term liability on the balance sheet, thereby reducing total liabilities if the sale of real estate eliminates debt on the balance sheet